Could 2022 be the year that cryptocurrency really takes off? What are some of the top cryptocurrencies to invest in for 2022?

Global events have inspired massive restructuring across the entire world’s economies. Market volatility, rising prices, blocked supply chains, hyperinflation, gas prices, food prices, rent increases, and forced lockdowns that devastated some markets and propped up others, have created concern about the future. All these factors and more have contributed to a major, and perhaps revolutionary change in the way that people do business, as well as changes the way that many people think about money.

This has also caused another unexpected turn – or perhaps expected to some – and that is the meteoric rise of cryptocurrency. This has made many people rich, but also, volatility in the crypto market and bad investment strategies have made some people poor. Because of this, it is important to share the number one golden rule of investing: Never invest what you are not willing to lose!

That said, let’s take a look at some of the top cryptocurrencies and rising stars in 2022. Innovation and useful technologies related to the blockchain and cryptocurrency sphere have been really taking off; and some of these cryptos could really change everything we know about finance, and how we do business, buy and sell, and go about our daily lives.

Methodology

Major Crypto Terms & Definitions

Educational, Not Financial Advice

Top 10 Cryptocurrencies in 2022

Methodology

The methodology of determining the top 10 include popularity, market capitalization, utility, and future-proofing. Popularity are the coins that are most popular. There is no such objective measure for popularity, except that it is known about by more people, like Bitcoin. Popularity does not necessarily equate to market capitalization. Just because a coin is popular does not make it valuable.

Market capitalization is the total amount of currency’s value as converted to fiat. While market capitalization does say something about the crypto’s popularity, it also says something about the crypto’s current value. What it does not suggest is anything about the longevity of the crypto. Just because a crypto has a high capitalization today does not necessarily mean that it will have value tomorrow.

Finally, we considered how future-proof a coin might be. This was not mathematical or scientific, but more the opinion of the author. There is no objective measure, because no one can predict the future. Anyone who says this coin will definitely go up (or down) is lying. They don’t know, because no one knows the future for sure.

Rather, the author considered what coins might be highly useful in the future, like XLM. Because of the utility of some of these coins, they could stick around even when some obscure cryptos fail. It is said that up to 95% of cryptos will fail, so utility is very important, because many meme coins probably won’t last once the meme fades into obscurity. One (DOGE) was included on this list due to popularity and for fun.

What we did not include in this list was stablecoins like USDT or USDC, which as of this writing hold the #3 and #5 spot for market capitalization, respectively. The reason we didn’t include them is because a stablecoin is simply a coin that is supposed to have the same value as a currency. As such, it is not necessarily an investment, as it provides little other benefit than simply acting as a holding bin for fiat.

People generally do not invest in stablecoins as an investment, but only to hold it in between trades of other crypto; and therefore, it seems that to a degree, holding the top spots on the charts is an artificial ranking, as it does not mean that people like it as an investment, but just that a lot of people have it. Since it’s tied to the currency, it is not resistant to inflation, and in fact has forced inflation at the rate of the currency it’s tied to. This top ten list was for actual cryptos, not stablecoins.

This article is not meant to tell you which coin to buy. It is merely to make you aware of interesting, major, and popular coins. This article is for entertainment, but still holds educational value.

Major Crypto Terms & Definitions

To help understand some of the words in this post, if you are not familiar with crypto or if you do not know much about it, knowing some key terms can help you better grasp it. Here are a few terms that can help you better understand what’s going on in the crypto markets and why some cryptos are better or more important than others.

Blockchain: Blockchain could be described as a huge file with data on every transaction performed on the blockchain. It works like a ledger, keeping track of everything. Some cryptos have a private blockchain, while others like bitcoin make every transaction public record.

Bitcoin: Since Bitcoin is the most well-known, some people think that Bitcoin means the same thing as “cryptocurrency”. It does not. Bitcoin is just one type of cryptocurrency, albeit the biggest and most well-known. But, Ethereum is fighting for the top spot presently.

Altcoin: Altcoins, or Alternative Coins, typically refers to any other crypto other than Bitcoin. There are thousands of altcoins. Some are useless except as currency, like memecoins; whereas others are highly useful and even revolutionary.

Stablecoin: A stablecoin is a cryptocurrency that is fixed to a fiat currency like USD (US Dollar). So, almost always a stablecoin will equal 1.0 stablecoin = 1.0 fiat like USD. It is used to save trading fees by keeping money in the wallet without first converting it to another crypto, or simply to store money in a wallet without worrying about the wild variations in price of other cryptocurrencies.

Fiat currencies: This refers to any government-issue currency which is not backed by anything. Since the world went off the gold standard, fiat currencies like USD and GBP have zero instrinsic value. There have been thousands of fiat currencies throughout history, and every single one has failed. Existing fiat currencies are virtually guaranteed to reach hyperinflation and eventually. Because of this, some investors see crypto as a solution to the eventual failure of fiat currencies.

Token: Token is another name for “coin”. It is the coin that is used for transactions of a cryptocurrency. Bitcoin’s token is BTC, for example. It is usually represented in all capital letters and is not usually an acronym (each letter does not mean something). It’s usually closer to an abbreviation, although sometimes the token name may be different from the crypto name, such as Polygon, whose token is MATIC.

Decentralization: Decentralization means that there is no central location where information is stored. A central bank is an example of the opposite, centralization, while a barter economy would be an example of decentralization. When a currency is 100% decentralized, it means that no one individual holds much power over the crypto, while a centralized system like a central bank holds all the power over that currency. All fiat currencies are centralized, but most cryptocurrencies like Bitcoin are decentralized (although Ripple is a notable exception).

Scalability: Scalability refers to the potential for growth. If a cryptocurrency is not very scalable, then it will result in traffic jams causing longer transaction times and higher transaction fees. If it is scalable, then more transactions can occur at the same time, resulting in faster transactions and lower fees. To overcome this problem, multiple layers (like multiple additional highways), and more innovative solutions have been invented.

Interoperability: Interoperability refers to the ability of a cryptocurrency to work with other cryptos or other systems. Difficulty in getting cryptos converted from one to another, for example, have resulted in innovation to make it easier, faster, and more secure to exchange information.

Immutable: This means that it cannot be changed. When a transaction is added to the blockchain, it is permanent and immutable. No one can remove that from the blockchain.

Fungible (or fungibility): This means that it has the same value anywhere. If it is exchanged with any other currency, it should have the same value no matter how or where you are using it.

Market Capitalization (or Market Cap): This is the total value of the cryptocurrency. It is calculated by the value of one coin multiplied by the total amount of coins in circulation. It does not mean the maximum value (or cap on the total), but rather it means simply the total value. If the value of one coin goes up, then the market cap goes up. If the value per coin goes down, the the market cap decreases.

Proof of Work (PoW): Bitcoin was the first to use this, and it is means that coins are mined. Once all the coins are mined, then that is the total number of coins that that cryptocurrency will ever have.

Mining: Mining is when an individual uses their computer, usually the CPU (processor) or GPU (graphics card) to run calculations, which results in occasional “rewards” given in the form of tokens. It is kind of like digging for gold. The work is the calculations or validation of a block, and if a reward is found, then the miner earns a token. Some coins like Bitcoin pool resources among many miners in order to earn rewards, because it is cost prohibitive or impossible to mine individually, as it takes too much computing power.

Proof of Stake (PoS): Proof of Stake is relatively new to the crypto field. Some believe it is better and more efficient than mining (proof of work). It is done by “staking” some of your coins to be used to validate transactions, and then earning profits on that, similar to earning interest.

KYC: This is an acronym that stands for “Know Your Customer”. Due to money laundering laws, especially in the US, most legitimate crypto exchanges require an extensive amount of personal information, even including a video of you, picture holding your id, social security number, and more, in order to allow you to convert fiat currency to cryptocurrency. Some exchanges allow to use it before you do KYC verification, but you will be restricted from using practically anything. You can, however, bypass KYC if you are merely exchanging from one crypto to another. But to get your fiat currency like USD from your bank account into a crypto in the first place, you’ll almost always need to do KYC in the US. Laws in other countries may vary.

Exchange: A crypto exchange is like a bank, and it is where you can easily convert fiat into cryptocurrency, or one crypto to another. Almost all legitimate exchanges have fees, and one exchanges are more expensive than others. It is less secure than a bank, though, as it can be vulnerable to hacking. So, it is said you should never store your crypto in an exchange if you intend on holding it for a long time. But the safest way to store your crypto is a hardware wallet, although it does cost money to buy a hardware crypto wallet.

Exchange Fees (Trading Fees): Most exchanges charge fees, which is usually a percent of the transaction. If the crypto has gas fees, then the exchange fee will be on top of the gas fee.

Gas Fees: Gas fees are fees, particularly with Ethereum and ETH-20 cryptocurrencies but also with other cryptocurrencies, that are charged in order to convert the cryptocurrency to another cryptocurrency, or to withdraw it as USD. Sometimes, gas fees could be higher than the value of the coin, so it isn’t just a percentage of the transaction.

Wallet Fees: If you use a wallet to transfer cryptocurrency to another cryptocurrency or fiat, you may also have fees.

Slippage: Slippage is the difference in how much the crypto is worth from the time you purchased to the time you converted it. It can be 0.5% to 3%, and sometimes as high as 25% or more. For highly volatile cryptos, this may result in getting significantly less of the coin that you purchased. While the exchange may convert it immediately, they may wait for some slippage before giving you the coin you converted. Some exchanges will intentionally wait for some slippage before sending it to you it in order to profit more from each transaction. It’s something like robbery, but there’s not much you can do about it.

Key: A key is a series of random words, usually 12 to 24 words long or so. Using this key can decode your wallet on the blockchain, so even if you lose access to your wallet, you can still retrieve your cryptocurrency that you own, albeit with some effort. Never ever share your key with anyone. If anyone including a thief gets access to it, then they can steal all your cryptocurrency.

Wallet: A wallet is the place where you store your crypto. It will have access keys (usually a series of words), and if anyone gets access to your keys, they will have full access to use your crypto.

Software Wallet: Not all exchanges have wallets. If your money is in an exchange, it may not be in a wallet. A software wallet could be mobile, or could be a software wallet. Do not trust any software wallet that is not listed as trustworthy on a popular website like this one. If you use an untrustworthy software wallet, they can steal all of your cryptocurrency.

Hardware Wallet: This is the most secure type of wallet, and is worth paying for it for the long term. It’s only worth it for large amounts of cryptocurrency. There are only a few trusted hardware wallets. If you lose your wallet, as long as you still have your key (a series of words), you don’t lose your crypto. And if someone steals your hardware wallet, then depending on which hardware wallet you have, the thief may not be able to steal any crypto from you, as long as they don’t have your key.

Wallet Fees: A wallet doesn’t have fees, but putting it into or getting it out does have fees. Some cryptos have more fees than others. Sometimes these fees could be higher than the value of your cryptocurrency, resulting in zero dollars remaining after fees. If you don’t know what you’re doing, it might be better to leave it on the exchange until you do learn what you’re doing. If you for example tried to transfer $200 in Ethereum to your hardware wallet, and then back to the exchange, then you could lose hundreds of dollars in fees, and end up with zero.

Crypto scammer: Anyone who asks for your keys, or who asks you to log into a website, or who asks you to click on a link, or who asks for a password, or who says they want to help you “validate” anything, or who asks for your keys to “help you”, etc. If you give a scammer access to your crypto, you will never see your crypto again, and there is no recourse, legal or otherwise. It’s like giving cash to a stranger on the street while blindfolded. Don’t do it. Be careful!

Smart contracts: Ethereum innovated and popularized smart contracts, which are digital contracts that facilitate the exchange of information between different parties or to exchange currency between different cryptocurrencies.

DeFi: Short for “decentralized finance”. It refers to all the financial services on the blockchain, especially Ethereum. Exchanges allow users to do virtually anything that banks can do, including earning interest, trading, derivatives, leveraging, and more.

dApps: This is short for “decentralized applications”. These applications work on top of the blockchain and are separate and distinct from it. They are also decentralized, so they have no central location where data is stored.

Educational, Not Financial Advice

It is worth noting that in January 2022, there was a considerable dip in most cryptos, pending results of the latest Federal Reserve regulatory meeting. This kind of volatility is somewhat normal in crypto, especially in the past couple of years. It should be expected that at any time, some particular even could lose you half or more of what your coin is worth, sometimes in a matter of days or hours, or even minutes.

While this page is not meant to be financial advice, a good rule of thumb for investing is to never invest more than 10% of your liquid assets. And, only do that much if you can afford to lose it. If you have $1,000 to your name, you probably should not invest much, maybe a few dollars at most. If you can say “meh” if your investment goes to zero, then it should be fine. Call this the gut check.

Never invest anything you won’t be ok with if it goes to zero, which it definitely can in this market. Someone on Reddit just put $50,000 in a new obscure coin. Things didn’t turn out well, and they lost 50% of it in a day. So be careful. This can happen with anything, even Bitcoin.

Market speculation, stock market, crypto, etc is very close to gambling, because no one really knows what the market will do. Don’t be fooled by the fancy charts and all the investors and so-called experts saying “buy this” or “buy that”. Again, not financial advice. Do your own research. If in doubt, do not invest. Do not gamble with money you need. Do not take this as financial advice, make sure to do your own research before investing a penny. That said, here are the top 10 crypto coins in 2022.

Top 10 Cryptocurrencies for 2022

1 Bitcoin (BTC)

What is Bitcoin? Bitcoin is the most popular cryptocurrency and the most well-known. It is what started the crypto revolution. Bitcoin was invented by Satoshi Nakamoto (likely a pseudonym, as he is anonymous) on January 3, 2009, shortly after he released a paper entitled, "Bitcoin: A Peer-to-Peer Electronic Cash System" on October 31 2008. Since then, thousands of new cryptocurrencies have been created, and several have become quite popular.

In 2020 to 2021, Bitcoin went through the roof and hit new all-time highs up to almost $70,000. The biggest mistake in my life, and it's too late, was to not build a bitcoin miner when I was going to do so, back in 2011. If I had, I'd have millions upon millions.

The big thing about Bitcoin is that every 4 years, it "halves". What this means is that when Bitcoin reaches a certain number of coins mined through Bitcoin miners, then the value of all the miners splits in half (because the difficulty of mining doubles), drastically reducing profit from mining (by half).

When this happens, as happened in 2020, and usually happens every 4 years, Bitcoin is likely to again go up even further. There are no guarantees though. Anything can happen. A teleporting dinosaur from the dark side of the moon could fly down and eat up all the solar panels. Who knows. Literally anything could happen. Ok, not literally.

Should you invest in Bitcoin (BTC)? Some say Bitcoin could go up to 100,000. Other say it could collapse back to 10,000. Regulatory concerns and other concerns should be considered. Do your research before investing in Bitcoin. Never invest what you are not willing to lose.

Official Bitcoin Website: bitcoin.org

2 Ethereum (ETH)

What is Ethereum? Ethereum is not exactly a cryptocurrency, contrary to popular belief. It is a "decentralized, open-source blockchain with smart contract functionality". Too complicated to understand? Truth is, you can buy and sell Ether on most exchanges just like you can with Bitcoin or other crypto, which helps to contribute to this confusion. What you are buying is Ether (ETH), which is the cryptocurrency of Ethereum.

The goal behind Ethereum was to create smart contract functionality so that it could facilitate interoperability between other blockchains. It's decentralized and open source, although due to its popularity, it currently suffers from slow transaction times and high transaction fees. This is all about to change, though, because soon Ethereum will be releasing Ethereum 2.0 which aims to solve these problems.

Just to convert ETH1 to USD or another crypto could cost more than what you have invested. These fees are known as "gas", and are one of the biggest problems with Ethereum. However, Ethereum developers are working to correct this problem soon, with the release of Ethereum 2.0 (ETH2). It will be the same coin, it will just be a hard fork that will result in lower transaction fees for anyone who owns Ether. A welcome and needed change, if it is successful.

Ether is a strong contender, and many speculate it could grow faster than Bitcoin in 2022. In 2021, its price skyrocketed up to near $4,000, 300% higher than December of 2020. It's possible it may go up, or it may go down. No one really knows, and we are in one of the most volatile global markets in recent history.

Should you invest in Ethereum (ETH)? While I am not going to give you any financial advice, and you should decide for yourself, it should be noted that the release of Ethereum 2.0, likely in 2022, may cause Ethereum to rise. Still, this is no guarantee, so do your research and do not invest anything you are not willing to lose.

Official Ethereum Website: ethereum.org

3 Polygon (MATIC)

What is Polygon? Polygon is the answer to Ethereum's high gas fees. Polygon is known as a "layer 2 solutions aggregator". What it does is provide further security, as well as being used to pay transaction fees, which lowers the cost of GAS fees (which are incurred on every trade), as well as making transactions faster.

With ETH, you could wait up to 10 minutes or longer for a transaction to complete, because the network is bogged down from too many people trading it. Polygon makes this transaction happen way faster, providing network decongestion and thereby lowering transaction fees. However, even MATIC increased GAS fees recently, due to heavy NFT gaming, according to investing.com. But, it's still cheaper than Ethereum GAS fees.

The downside is that ETH-20 tokens like new novel crypto coins, may not be available on the Polygon network, which means you first have to convert it to something like Wrapped Ether (WETH), and then back to Ether (ETH), to get it from the Polygon (MATIC) network over to ETH. Not only is it an additional step (both ways), but this also incurs additional GAS fees (both ways). And this GAS can only be paid in ETH. So, there's that.

But this is still a promising coin, and as more coins get added to the Polygon network, it will have even more utility.

Should you invest in Polygon (MATIC)? Polygon is a new and upcoming crypto with a lot of promise. It has a lot of potential, but also there are no guarantees. Do your research first and then choose what to invest in, as long as you are also okay with losing whatever you invest. Don't invest if you can't afford to lose it.

Official Polygon Website: polygon.technology

4 DogeCoin (DOGE)

What is DogeCoin? DogeCoin is merely a meme coin (not a serious one), but it was made famous when Elon Musk famously began tweeting about it. Perhaps he meant it as a joke, but then people realized the power of the Musk Effect. When Musk tweets about something, it affects the stocks, like it or not.

The fact is that some people made some money when DogeCoin went up (and some people have lost money, too). It made it clear that meme coins are a little more than a joke. Even if only a little more, and not a lot more. Should you invest? That's up to you. Meme coins might jump or crash at any time. It's basically straight gambling.

Doge is a meme from the early 2010s, with the picture of a Shiba Inu. The developers, Billy Markus and Jackson Palmer, created the DOGE crypto as a joke, but it caught on, and became probably the most popular meme coin.

What is Shiba Inu (SHIB)? Because of its popularity, another meme coin is also taking off, Shiba Inu (SHIB). SHIB is a different project but the the same goal, providing a crypto to profit off memes through market speculation. It is also decentralized. Watch out with meme coins, as any day they can go from zero to hero, or hero to zero overnight. So be careful and don't invest what you can't afford to lose.

Should you invest in DogeCoin (DOGE) or Shiba Inu (SHIB)? Dogecoin and Shiba Inu are memecoins with no real use besides as a currency and as a joke. Dogecoin has the benefit of having Musk behind it, while Shiba Inu has the benefit of being newer, and cheaper. If you invest, it should be for fun. Maybe you'll make money, maybe you'll lose it all. Think of it like gambling. Once people forget about the "doge" meme, it will probably disappear into oblivion. Don't invest anything you aren't willing to lose, just like any crypto or stock. Make your own decision.

Official DogeCoin Website: dogecoin.com

Official Shiba Inu Website: shibatoken.com

5 Stellar Lumens (XLM)

What is Stellar Lumens? Stellar Lumens enables instant, fast, and cheap transfer across the world in ways that other cryptos cannot. Launched in 2014, it seeks to replace traditional payment providers with a way to instantly exchange currency anywhere, anytime, across the world. They recently partnered with MoneyGram as well, which lends XLM further credibility.

Anything from other crypto to traditional fiat currencies like USD or GBP (or any other currency), could be immediately exchanged, without having to go through banks, wire transfers, and so on. Moreover, it can be done across borders, and with even very small amounts.

For example, if someone in Australia wanted to send $10 to someone in Canada, they could do it, instantly, and cheaply. This would not be possible using transitional payment processors or wire transfers, because it would incur transaction fees that would eat up most of the payment. This is where Lumens shines, pun intended.

XLM could really change the world.

Should you invest in Stellar Lumens (XLM)? Stellar has the ability to change the world, but like anything, there are no guarantees. Don't invest your life savings into any crypto. Make your own decisions and consider if you think it will be a wise investment. Just remember not to invest it if you aren't willing to lose it.

Official Stellar Lumens Website: stellar.org/lumens

6 Monero (XMR)

What is Monero? Monero is a privacy coin. Contrary to popular belief, most other crypto, including Bitcoin and Ethereum, can be tracked and traced rather easily, because every transaction is a matter of public record. That's how it works, and it's one reason why Bitcoin is generally considered safe, as long as no one gets access to your account. Monero, however, is completely untraceable.

While you might think you are doing nothing wrong, there are many legitimate cases where exchanging crypto (or any currency) is something that people do not want made public. Moreover, it is at risk of censorship, because someone tracing the transactions put put the safety and security of the individual at risk. Not just nefarious people, but good people at risk of censorship by nefarious governments and corporations.

Monero solves this problem, by making all transactions completely confidential and anonymous. While this could certainly be used by nefarious parties, the truth is that the 99.999% of people should not be restricted from privacy just because 0.001% might do something bad with it. Therefore, Monero is a true privacy coin that actually does what most people probably think Bitcoin does - truly makes the payments anonymous.

The catch is that if you buy Monero from anywhere traceable, it could be traced that you have Monero, although it can't be traced what you used it for. That could be enough to get you in trouble. If you bought on any crypto exchange, then it's no secret. The only way to keep Monero private is to either mine it, or to receive it anonymously from another person.

Due to Monero's position as the most popular privacy coin, it is fair to say that it's a top crypto coin, because it fills an essential gap in the crypto markets, as a privacy coin.

Should you invest in Monero (XMR)? The purpose of Monero is for privacy. It's better to mine it if you care about privacy, because there's almost no way to acquire it anonymously by purchasing it. But if you do buy it, keep in mind that anything can happen in this world. It could go up, or down. Don't believe anyone telling you it will definitely go up or down, no one knows the future. Just invest only what you are willing to lose, and not a penny more.

Official Monero Website: getmonero.org

7 Cardano (ADA)

What is Cardano (ADA)? Cardano has been called the "ETH killer". The reason is because after a disagreement between the founders of Ethereum, one of the founders, Charles Hoskinson, left and co-founded Cardano, a Proof of Stake (PoS) coin. It's not a piece of S. In fact, it's quite good.

The developers of Cardano have written more than 120 papers with peer-reviewed research and experimentation to create Cardano. Because of this, many think that Cardano may be superior to Ethereum, because its blockchain may have more capabilities than ETH.

The limitation with Cardano is that because it is new, it is limited by way of DeFi applications (which means Decentralized Finance, also known as dApps). This is only a matter of time though. Cardano is working on decentralized finance apps similar to those available on Ethereum, which could make it the world's financial operating system, as the developers seek to do.

Cardano is the seventh largest coin by market capitalization as of January 2022 (It's coincidence that it's also seventh on this list, as several in this list are not in the top 10 by market capitalization, which means total value of the coins owned).

Should you invest in Cardano (ADA)? Cardano is relatively new with a lot of promise. Still, it's impossible to know the future. If it wins the gambit, it could be a good investment. But if it loses to Ethereum 2.0, it might not. No one really can be sure. Do your research and make your own decision. Don't invest what you can't afford to lose.

Official Cardano Website: cardano.org

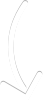

8 Cosmos (ATOM)

What is Cosmos (ATOM)? Cosmos did something no other crypto has done. It provides a way for all different cryptos to have a way to communicate with one another easier. It is called the internet of blockchains, because it provides a generic method for blockchains to move from one to the other.

Cosmos (ATOM) has facilitated some of the major cryptos such as BNB and Tera (LUNA). Just like the internet, Cosmos works using local hubs, which allows thousands of blockchains to connect to it. Instead of the cryptos having to connect to one another, they can connect through one of the Cosmos hubs and allow faster and easier transfers between currencies.

It is also some of the most secure and scalable of all cryptocurrencies. Tendermint, the novel Proof of Stake (PoS) can handle up to 10,000 transactions per second and continue to work even if 1/3 of the nodes are offline. It facilitates the creation of new blockchain applications in weeks instead of years.

Because of the utility and essential nature of Cosmos, it is one of the best and most useful cryptos today.

Should you invest in Cosmos (ATOM)? Cosmos looks promising and could change the world and the way that cryptos work. But of course, like everything, nothing is certain. Do your research and make an educated decision and don't invest what you aren't willing to lose.

Official Cosmos (ATOM) Website: cosmostation.io

9 Polkadot (DOT)

What is Polkadot (DOT)? A new and upcoming coin, Polkadot was released in 2020 by one of the co-founders of Ethereum, Gavin Wood, and it is already in the top 10 cryptos by market capitalization. Because it seems to be a promising crypto with a lot of utility, it is also included in the top ten of this list.

Polkadot seeks to make transactions on the blockchain more secure, private, and efficient, decreasing costs and making transactions faster. User data remains private, and Polkadot seeks to make transactions more secure and more decentralized. They also seek to make blockchains more resilient to crashes.

The major benefits of Polkadot include a 100% decentralized network, fast and cheap transactions, and proof of stake (PoS) without users needing to mine to earn. Users just stake their coins in the wallet, and they can earn more coins. Its motto is "community first", and the premise behind it is to provide rewards as well as to facilitate a faster, cheaper, and more secure blockchain.

Since DOT can run on any blockchain, it can provide increased security and functionality to existing and legacy blockchains. It has been designed to be both interoperable and scalable, to solve existing problems with blockchains. Because of these benefits, Polkadot is more than innovative, it has been called revolutionary, and could change the way we use the internet. They claim to be Web 3.0.

Should you invest in Polkadot (DOT)? Polkadot sounds like it's going to fix a lot of problems, and it's doing well now. But anything could happen. Should you invest? Decide wisely. If you invest in any crypto, don't invest more than you can afford to go to zero tomorrow.

Official Polkadot Website: polkadot.network

10 Ripple (XRP)

What is Ripple (XRP)? Ripple came under fire and criticism because the SEC filed action against the founders for running an unregistered security. As a result, it was banned or restricted on some major exchanges, and these events caused its stock price to plummet. It also raised questions about cryptocurrency in general.

Ripple's goal is unlike many other cryptos, in that their plan is to appeal not to the masses, but to the banking and finance institutions. This is both encouraging and concerning. While working with major banks and legitimate finance institutions lends credibility, it also usurps the spirit of cryptocurrency which is to decentralize money, not to further support centralized money.

Ripple Pros

The good things about Ripple are that it can process transactions at an astoundingly higher rate than other banking institutions. However, it is not as fast as some other cryptos. Because it partners with major financial institutions and has better major investors, this lends it credibility. However, it also has the opposite effect for those interested in the freedom and utility to consumers that the idea of cryptocurrency promises. Ripple allows flexibility of use by financial institutions, by offering them to either use XRP, or to use what they call IOUs, which can effectively be used for any other currency including fiat. But institutions also need to use XRP for the price to go up and benefit investors.

Ripple Cons

Some of the downsides to Ripple are the regulatory concerns, as well as being centralized. Much of Ripple, including XRP, would cease to function if Ripple were to go out of business or became compromised, unlike other cryptos which are decentralized. Due to centralization, investors must trust that the Ripple owners will do the right thing.

Ripple owners issued 10 billion XRP at the beginning just one time, with the intention of never issuing any more; but the fact remains that they do have the ability to debase their currency by issuing more, if they want to for whatever reason. Therefore, it is not finite, which removes one of the major benefits of crypto, that it has a limited supply. Other cryptos like Bitcoin are limited by the physical laws of statistics and mathematics, which are unalterable, thereby making the supply of Bitcoin effectively finite.

Because Ripple is centralized, an important aspect of the cryptocurrency is getting institutions to use XRP and not IOUs. If institutions instead opt to use their own currencies through Ripple by using IOUs instead of XRP, then the price of XRP will stagnate, and not rise, thereby removing much of its potential probability. For it to be a good investment, institutions will need to utilize XRP instead of their own currencies.

Another downside of Ripple is that working with major financial institutions and falling under regulatory jurisdiction limits the utility to consumers. And worse, it puts the consumers at greater risk, because Ripple has devoted to reporting to the government to fight money laundering, which is a wholly failing endeavor that only takes away freedoms and rights from citizens in a vain and failed attempt at stopping criminals.

Is ripple a good investment? Betting on Ripple is betting that Ripple will win against the SEC and ongoing legislation, that it will be adopted by many major financial institutions, and furthermore that it these institutions will utilize XRP, instead of IOUs. The reality of the matter is that Ripple is highly controversial to everyone involved, including regulators, institutions, and consumers. This could be beneficial or detrimental to the future of Ripple and XRP.

Should you invest in Ripple (XRP)? While Ripple shows some promise and is doing great, do keep in mind the regulatory concerns as well as the centralized aspect of it. Your activity will be reported to the government to keep up with money laundering legislation. If you still like Ripple, then just remember not to invest more than you are willing to lose.

Official Ripple Website: ripple.com

11 Avalanche (AVAX)

What is Avalanche (AVAX)? As a runner-up to the top ten list, but not to be excluded, Avalanche is a new and up-and-coming coin that's doing very well, rapidly rising to the top of crypto charts since its release in 2020. It has very low fees and can be used to swap coins between exchanges cheaply.

But there's more than just low fees, because Avalanche has the quickest execution of any crypto coin, making it the fastest and cheapest coin to exchange. The goal of Avalanche was to provide a faster and cheaper method of exchanging currency, while still retaining the crypto benefits of security and decentralization.

AVAX has greatly improved DeFi by allowing users to easily make their own applications on top of existing ecosystems, or entire to create entire new blockchains. It allows scalability and fast speeds for dApps, allowing 4,500 transactions per second. This is one of the fastest payment systems available, of any kind. Of course, it is tremendously faster than the traditional institutions, which are like snail mail compared to Avalanche.

By combining speed and scalability with decentralization and interoperability, Avalanche seeks to change the game and help improve the crypto world, as well as facilitate the creation of new blockchains.

Should you invest in Avalanche (AVAX)? Avalanche is currently very affordable compared to many other cryptos, so you can get a lot of it for a relatively low cost at the moment. This may change. However, lke any crypto, or any investment, you always risk losing your money, so just be careful and don't invest anything you aren't willing to lose.

Official Avalanche Website: avax.network

Which crypto coin is your favorite? Do you think that cryptocurrencies are really going to change the world? Do you think that they could replace traditional means of payment? Why do you think crypto is taking the world by storm?

Disclaimer: The author of this article may hold some of these crypto coins. This article is only the opinion of the author and is written to be unbiased. Nonetheless, it is NOT intended as financial advice and should be considered for entertainment only. Do not make a financial decision based on this article, or any article on any website, for that matter. Do not listen to the so-called “experts” telling you to buy this coin or that coin. Research for yourself.