Stocks and crypto, as well as gold and real estate, are potentially in one of the biggest bubbles in history. How does the current bubble compare?

Recently we discussed some of the top cryptocurrencies in 2022. However, it must be noted that while these cryptos may indeed change the world, we also may very well be in one of the biggest bubbles in recent history, both in cryptos and in the stock market. There are other facets of the economy in a bubble too, including real estate. The bubbles can’t last forever.

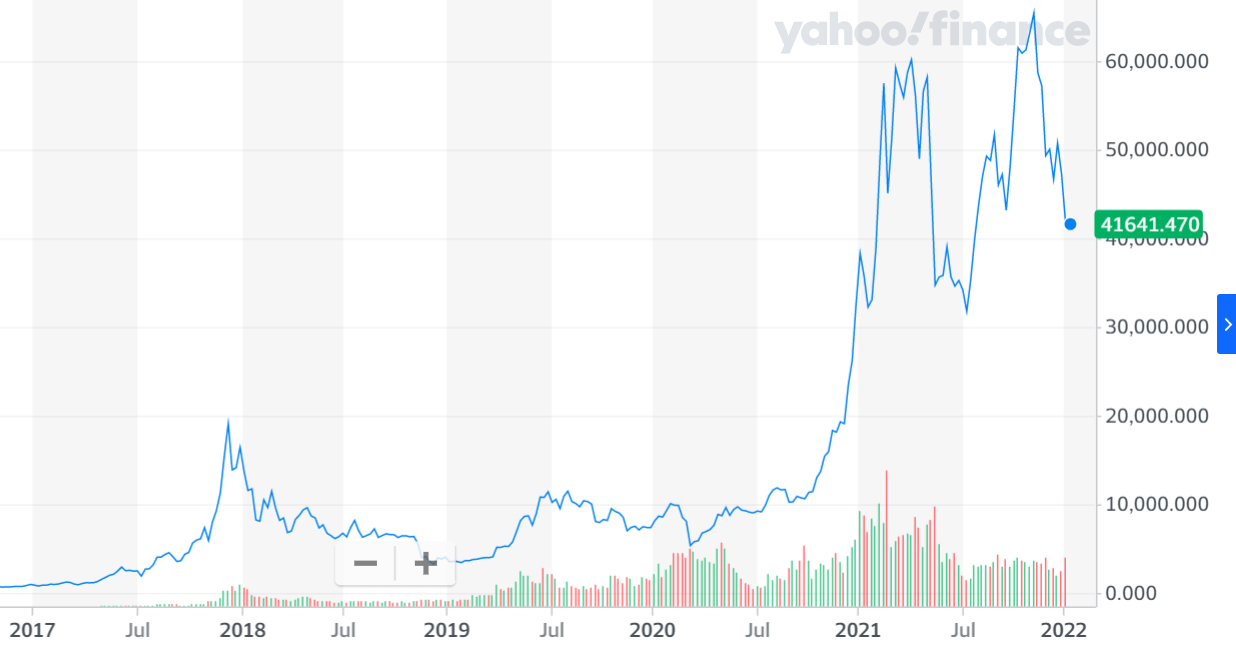

We know that it is likely a major, mega bubble, because the meteoric rise of many stocks and cryptos was too much, too fast. Stocks like Tesla (TSLA) went from about $50 in late 2019 to over $1200 in October of 2022 [1]. Bitcoin (BTC) went off the charts to $70,000 [2]. Stocks like Gamestop (GME) based on a social media anomaly, and even meme coins like DogeCoin (DOGE) and Shiba Inu (SHIB) have skyrocketed.

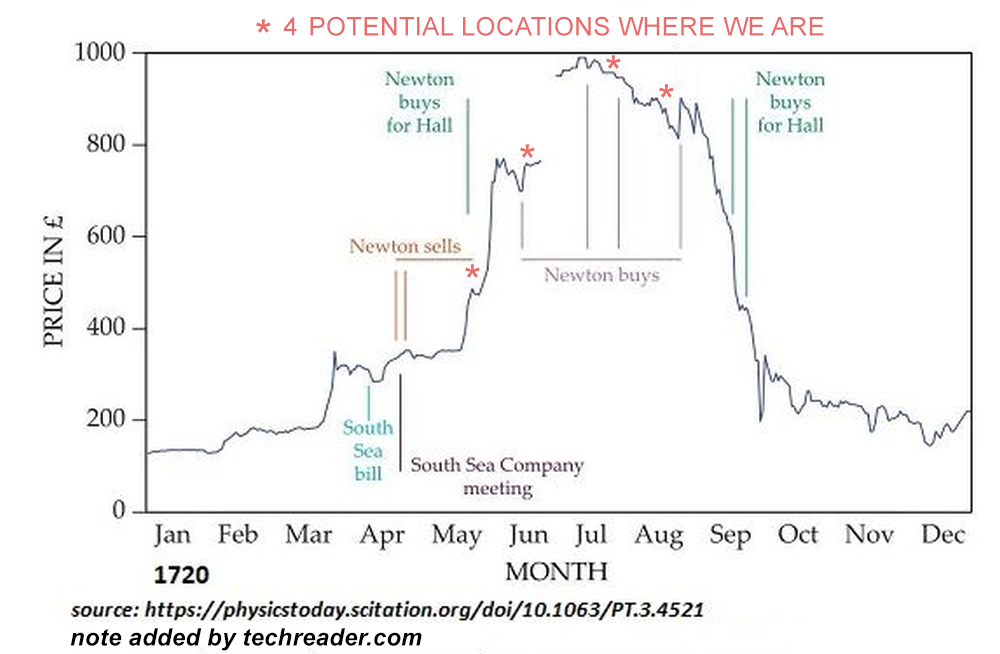

Why is this important? Because if you buy at the peak of a bubble, you will lose it all when it inevitably comes crashing down, like happened to Isaac Newton when he invested at the peak of the South Sea bubble. Those who do not realize they are in a bubble when they see one, will find out the hard way.

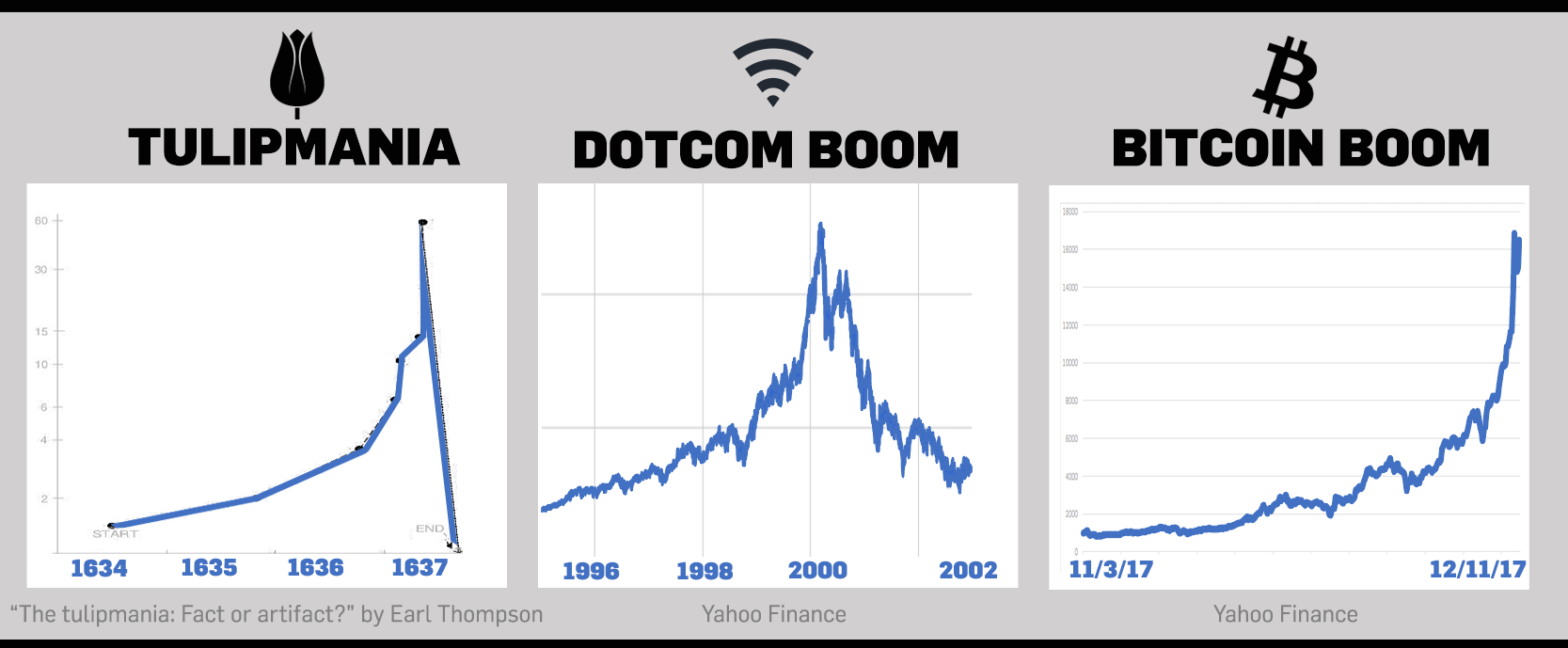

Historically, whenever the market goes crazy and skyrockets astronomically, what we are looking at is not a new price for the stock (or recently, a crypto), but rather we’re looking at an anomaly. It happened with tulip bulbs in the 1600s (dubbed Tulipmania), the Mississippi bubble of the 1700s, the Bull Market of the Roaring 1920s, the Bubble Economy of Japan in the 1980s, the Silver Bubble of 1979-80, the Dotcom bubble of the 2000s, and the Bitcoin Bubble of 2018, to name a few.

The more people who are involved, the bigger the bubble. Not all bubbles pop overnight, as there are a couple long-term bubbles today, including the California Real Estate Bubble. But, there are factors that cause these bubbles to continue for a longer period. Eventually, however, these and all bubbles will burst, because the price of the stocks are massively inflated and do not match the value of the good.

How do we know we’re in a bubble?

We know that we are in a bubble because for a long time, the stocks and cryptos were valued at their real value, and suddenly they skyrocketed, virtually overnight. Every time this happened, it ultimately crashes, sooner or later. The question is whether the bubble we are in is even a bigger bubble, or whether it’s going to collapse. That is, the question is not if, it’s when.

What is not a bubble is that before a particular stock or item has value, it holds a low value, but when it is brought to market, it jumps in value and stays there. For example, the slow and gradual rise of Google and Apple stocks since 2005 until 2019 is not necessarily a bubble, because it represents real value, and the growth of massive tech companies. But, the meteoric rise of both of those stocks since 2020 is a bubble. Such stocks may not crash to zero at the end, but their prices are unsustainable.

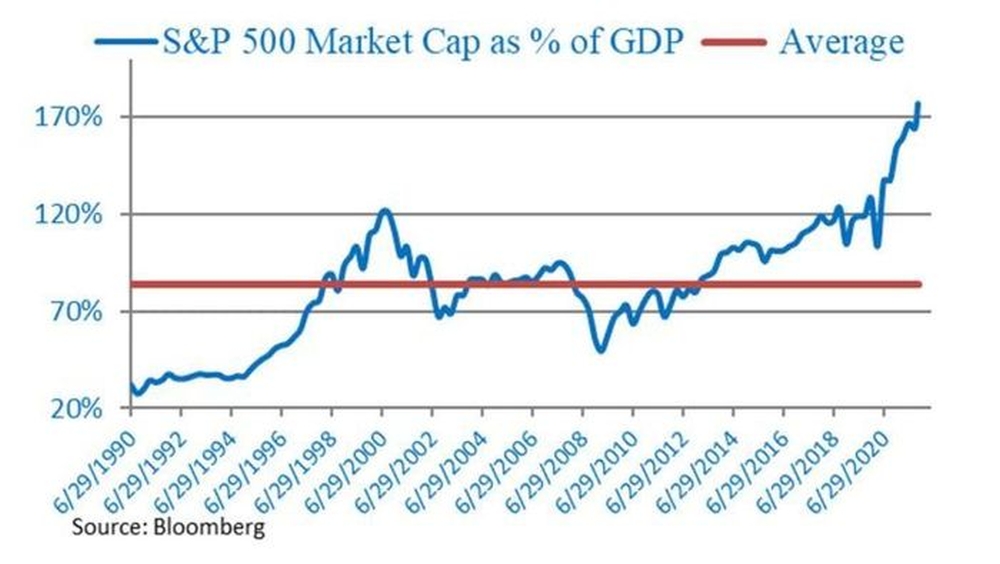

Additionally, top investors are also agreeing that it’s a bubble. Warren Buffet suggests that “stocks are hugely overvalued and a crash may be coming” [3]. Fortune is calling it a bubble, and discussing about when, not if, it will crash (they suggest October of some year unknown in the future) [4]. Michael O’Rourke, chief market strategist at JonesTrading, said that “It can’t be any clearer than the fact that the S&P 500’s market capitalization is 177% of U.S. GDP” [5]. He cited this chart showing that the S&P 500 is too high:

The charts below were made in December of 2017, to warn against the 2018 bitcoin crash.

They were right. take a look at the other side of the bitcoin bubble of 2018:

Now take a look at the 2020-2022 bitcoin bubble, and where we are:

Source: BTC-USD Interactive Stock Chart [2]

The charts above are also exactly what Google, Apple, Amazon, Tesla, altcoins, and other tech stacks look like. They are all following the same trend, the formation of a bubble. Some bubble can last a decade, but others last a year or two. When they crash, they crash fast.

Now the Tesla, Apple, and Google charts:

Source: TSLA Interactive Stock Chart [1]

Source: AAPL Interactive Stock Chart [6]

Source: GOOG Interactive Stock Chart [7]

You can see clearly these exactly match the signs of a bubble which is headed toward a peak before it inevitably crashes.

Why does a bubble pop?

A bubble can pop due to many reasons, but sometimes it can be a very simple and seemingly meaningless thing that causes the bubble to pop. Bubbles become more unstable the larger they grow, and it takes major events to sustain them over a longer period. It is certain that the current bubble of many stocks and cryptos is caused by the current global events; but when it will pop is uncertain. If it were possible to know for sure, then Isaac Newton wouldn’t have lost his fortune.

How do you react to a bubble? First of all, know it’s a bubble, and do not delude yourself to think that it’s really the new price representing a particular good or company. Do not delude yourself to believe that TSLA or BTC will go to 100 trillion. There is only so much money in the world, and eventually, people en masse will start to realize this and begin taking profits. Once institutional investors and whales start taking profits, the price starts to drop. Eventually, everyone bails, and the market collapses.

5 stages of a bubble

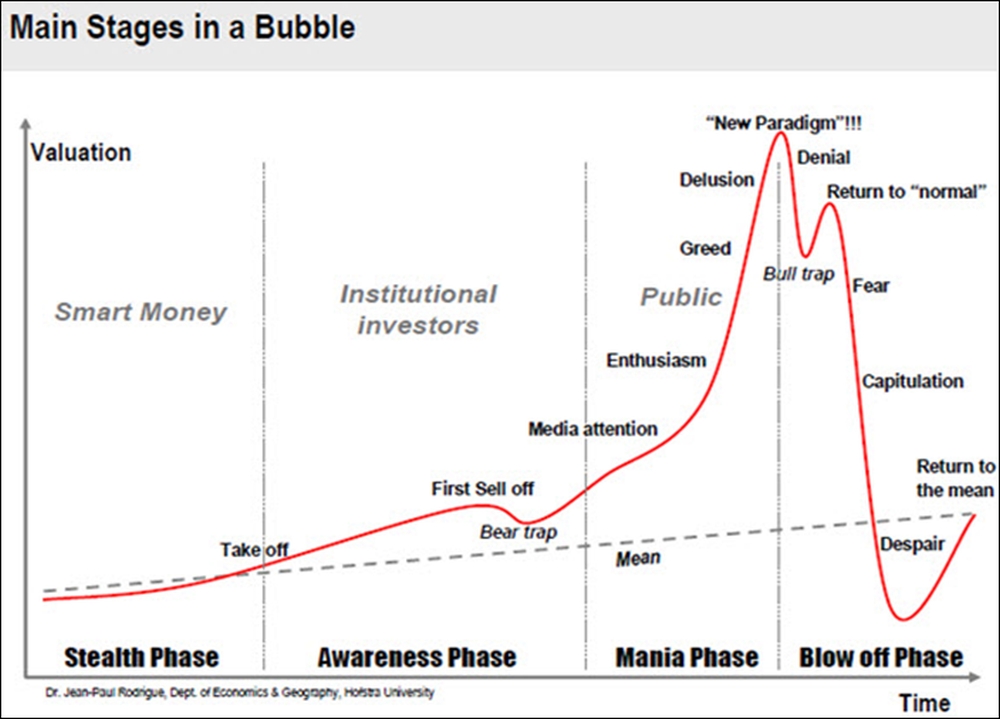

While there is no standard figure for a bubble, because every one is a little bit different, you can see general trends in bubbles, and the below chart shows some major stages. The fact remains that in a bubble, it goes from normal, to sky high, and then crashes back to normal. It does not stay sky high forever.

Source: Forbes [8]

Others suggest there are 5 stages to a bubble: Displacement, Boom, Euphoria, Profit-taking, and Panic [9]. Here are the 5 stages of a bubble and how they relate to our current bubbles:

1. Displacement

This occurs when a new paradigm occurs, and investors get enamored by some new idea. In this case, there was a perfect storm: the combination of global events, fear about stability of fiat, people forced to stay at home, free money from the government, unemployment, uncertainty about the future, and also the rise of crypto awareness, social media, new apps, new trading platforms that made it easier than ever for newbies to get into investing, fractional investing (allowing lower-income people to buy a fraction of a big stock worth a lot, instead of having to buy a whole share at $1000+ each), and even the low and no-fee investment brokerages that have made it easier than ever for anyone and their mom to jump on their phone. Add to this faster internet, faster phones, better technologically-equipped millennials and gen-zers, better access to apps, supercomputers on your phone, and more, all these have created a perfect storm for a wave of a bubble to rival any before in history.

2. Boom

Boom is what occurred in 2020. After the early 2020 stock market crash, it recovered quickly and then turned into a bubble. Stocks and cryptos went from a horizontal line into an almost vertical line, virtually overnight. As more and more individuals and investors enter the market, it continues to boom, more and more. Many fear missing out on a once in a lifetime opportunity, and boom turns into a bigger boom. And turns into a bubble.

3. Euphoria

At this stage, the boom is high, and more and more are continuing to enter the market. Some believe the bubble is going to last forever, and it becomes the new baseline for new investors. Many begin to throw caution to the wind, and go all-in so as to not miss out on maximum profits. The bubble gets bigger and bigger. People around the country and in less-gotten communities start getting involved and continue to grow the bubble. Even foreign investors start getting involved, further growing the bubble.

4. Profit-Taking

The bubble is so big now that the smarter investors are coming to their senses and realizing this is a big red flag. They start heeding the warning signs of a market collapse, and realize that the time has come to take the profits. When they do, and they start selling their positions, the market begins to falter. Then it begins to drop. Then all heck breaks loose.

5. Panic

This will be the end of the bubble. Once the price starts to drop past a certain point, other institutional investors will be forced into “stop losses”, which is a finance term meaning the software will sell the stock if it goes below a certain point. Once this happens, the stock drops even more. And once that happens, that’s when the final stage of a bubble happens, the Panic stage. Once panic sets in, the majority of investors bail on the stock to cut their losses, and the market returns to its original state.

What happens next?

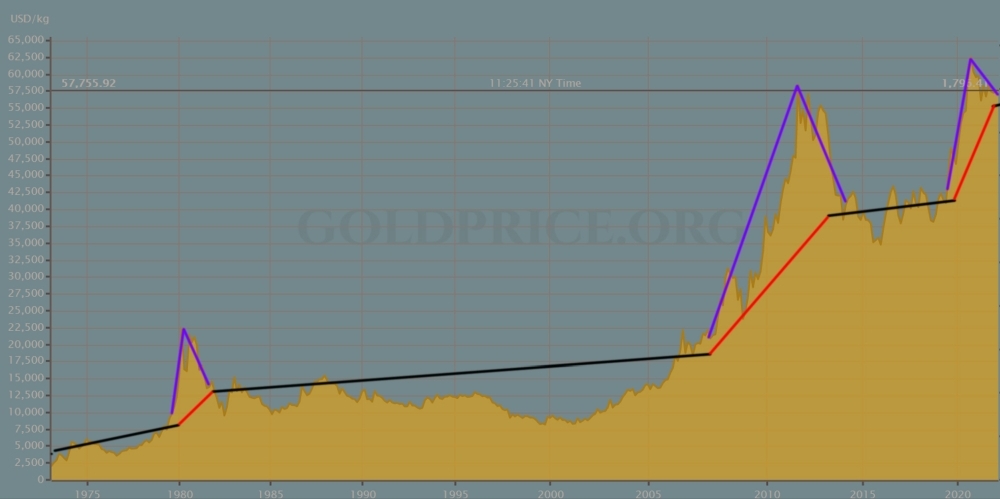

Sometimes, when a stock or crypto collapses, it does settle at a higher value, although this could be a longer-term bubble. Gold [10] and Silver [11] had a spike in 1980, and then returned to two times the original price. The same occurred again in 2008: a spike, and then another return after the bubble popped to 2x the original price. But, some markets return to the same or lower than the pre-bubble price. When Tulipmania bubble popped, the price returned to original levels. Then the 2000s real estate bubbles popped, 500k+ houses became 100k houses again.

Take a look at the gold bubbles of 1980, 2008, and 2020:

Source: Chart pulled from Goldchart.org [10], trend lines made by author.

Notice how there was a spike and then return to normal. For silver and gold, after each spike, they doubled in value during the next phase. But this does not always happen. Silver followed the same exact trend during the same times. The 2020 bubble is different though, because it’s lower proportionally. This is probably because there is a crypto bubble instead, so the gold and silver buyers are buying bitcoin and altcoins instead. The bubble isn’t over.

What does this mean for you?

If you are invested in stocks or crypto, know you are in a bubble. It will not last forever. It might continue to go up for awhile, or it could collapse faster than you can open your trading page and cash out. Sometimes, it could go from the peak to the bottom in a matter of hours or even minutes. Once that happens, it’s the end of the bubble. In some cases, the original company could go out of business; while in other cases, the stock simply returns to normal. Either way, some people are going to lose a lot of money, especially those who thought it would last forever.

This post is not meant to tell you to invest while early, nor is it to tell you to cash out because you could lose it all. Instead, it is to give you a picture of the reality of the situation, and compare it to historical events. This may be the biggest mega bubble in recent history, perhaps in all of history.

The current bubble could continue to go up and up and up for a few more years, or it could collapse any day now. No one really knows, or could know; but as a famous economist said, “The market can stay irrational longer than you can stay solvent.” In other words, the market will remain unpredictable longer than you will have money to speculate on what it will do next.

Sources

[1] Bitcoin USD (BTC-USD) Interactive Stock Chart | Yahoo Finance

[2] Tesla, Inc. (TSLA) Interactive Stock Chart | Yahoo Finance

[4] The next recession: Here’s when the ‘everything bubble’ will burst | Fortune

[5] Doubting that we could be in a stock-market bubble? Here’s the chart you need to see | Marketwatch

[6] Apple Inc. (AAPL) Interactive Stock Chart | Yahoo Finance

[7] Alphabet Inc. (GOOG) Interactive Stock Chart | Yahoo Finance

[9] 5 Stages of A Bubble | Investopedia

[10] Gold Price Chart | Goldprice.org

[11] Silver Price Chart | Silverprice.org

Cool