So you lost your job through no fault of your own. You may be eligible for unemployment benefits. Please note that these benefits are not charity or free money from the government. 100% of unemployment benefits are paid by your former employer. It’s just a way to bleed your employer who fired you for a little more money, in some circumstances, to help you survive while finding a new job. There is no shame in it. This can be very helpful especially if you have little to no savings and now have to search for another job.

It could be months or more before you find a new job, so you should definitely take advantage of unemployment benefits if you are eligible. If you want to be ethical, then just really look for another job. That way the unemployment benefits help sustain you so you don’t become late on rent or the mortgage or run out of food while trying to find a new job. You can use unemployment benefits for anything, it is your money. You could even legally gamble it away, but don’t do that!

That said, the agencies which oversee unemployment insurance are often cruel, heartless, faceless agencies who care more about not helping you as much as possible than ever lifting a finger to help. Worse, it is extremely complicated, and if you have never filed before, you are in for a lot of stress trying to get the proper information. That is why I created this post to help you.

Please note that this is for California Unemployment, also known as EDD, which stands for California Employment Development Department; however the information does still apply to other states, although the benefits amounts, phone numbers, and other information may vary.

In short, how it works is as long as you make a total gross income in the base period year of $23,400 or more, you get 26 weeks of $450. If you make over $11,674.01 total in any quarter of your base period, even if you only made $12,000, you still get $450 per week, but the total benefit amount is 50% up to a maximum of $11,700 benefit amount, which is $450 x 26.

EXAMPLES:

See the following examples.

EXAMPLE 1:

If you earned $23,400 OR MORE total (gross income) in the base period year,

AND at least ONE quarter you earned a total of $11,674.01,

then:

- You get $450 per week (determined by one quarter of at least $11,674.01)

- You get $450 for 26 weeks ($30,000 x 50% = $15,000, maximum is $11,700 benefit)

EXAMPLE 2:

If you earned $19,000 total (gross income) in the base period year,

AND at least ONE quarter you earned a total of $11,674.01,

then:

- You get $450 per week (determined by one quarter of at least $11,674.01)

- Your maximum benefit amount is ($19,000 x 50% =) $9500

- You get $450 per week for ($9500 / $450 =) 21 weeks

EXAMPLE 3:

If you earned $19,000 total (gross income) in the base period year,

AND the highest quarter was $4750,

then:

- You get $183 per week (determined by one quarter of at between $4,732.01 – $4,758.00)

- Your maximum benefit amount is ($19,000 x 50% =) $9500

- You get $450 per week for ($9500 / $183 = 51 weeks, maximum is 26 weeks) 26 weeks

- Your actual total benefit amount is $4,758

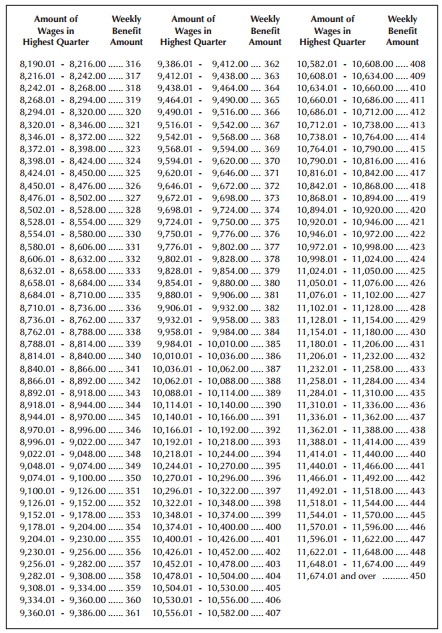

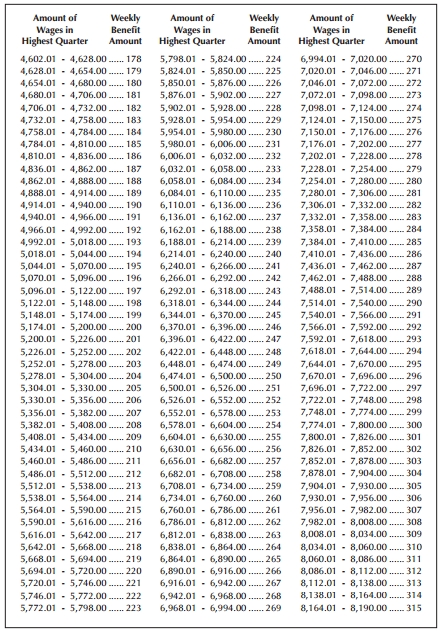

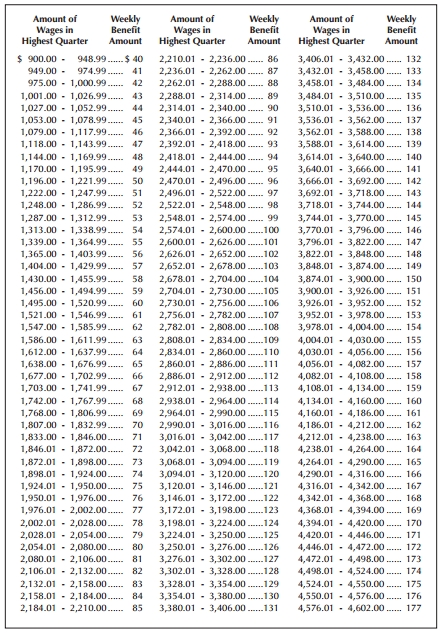

- See the chart at https://www.edd.ca.gov/pdf_pub_ctr/de1275a.pdf to determine your weekly benefit amount.

- The remaining unpaid amount ($9500 – $4758 = $4742) will never be paid. You don’t get this amount. The only way to get it is to have a higher weekly benefit amount. The only way to get all of it is to have a $450 benefit amount.

KEY TERMS:

Claim Beginning Date: Your claim begins on the Sunday of the week in which

you filed your claim. It is not based on the date you became unemployed.

Claim Ending Date: This is the date your claim year ends. This date is 52 weeks

from the claim beginning date. Benefits remaining on this claim cannot be paid for weeks claimed after the claim ending date. A new claim must be filed if you are still unemployed or partially unemployed after the claim ending date.

Maximum Benefit Amount: The maximum award is 26 times the weekly benefit amount or one-half of the total base period wages, whichever is less.

Total Wages: This is the total amount of earnings reported by your employer(s) during the base period. These earnings were used to compute your maximum benefit amount.

Base Period: Your base period is a 12-month period of time.

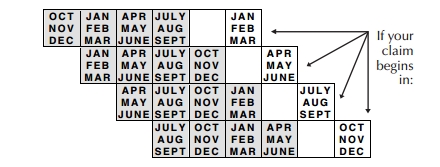

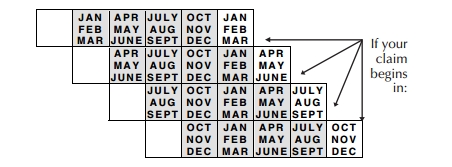

Standard Base Period: The Standard Base Period is the FIRST four of the last five completed calendar quarters prior to the beginning date of the UI claim.

Alternate Base Period: The Alternate Base Period is the LAST four completed calendar quarters prior to the beginning date of the claim.

Weekly Benefit Amount: This is the amount you will receive each week if you meet all eligibility requirements.

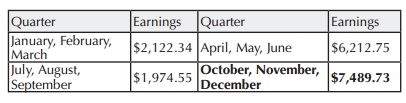

Highest Quarter Earnings: Your base period is divided into calendar quarters. The quarter that you were paid the highest amount of wages determines your weekly benefit amount. An example of Notice of Unemployment Insurance Award is shown below with earnings for each quarter:

Waiting Period: The first week of unemployment will be unpaid. That means that you file for your first two week, but your first payment will only contain one week of payments.

UNEMPLOYMENT BENEFITS TABLES:

Unemployment Insurance Benefit Table

For New Claims With a Beginning Date of January 2, 2005, or After

REQUIREMENTS:

Requirements to receive benefits:

You must have lost your job due to no fault of your own. Being laid off is the most common reason. If you were fired due to poor performance, disputes with management, theft, etc., then you cannot receive benefits.

There is a question regarding your eligibility if you:

• Quit your job.

• Were fired from your job.

• Are out of work due to a strike or lockout.

• Do not have child care.

• Do not have transportation.

• Do not look for work as instructed.

• File your claim late.

• Mail your claim forms late.

• Certify late using EDD Web-CertSM or EDD Tele-CertSM.

• Refuse a job.

• Give incorrect information or withhold information.

• Fail to participate in re-employment activities.

• Are a school employee filing a claim during a recess period.

• Are a professional athlete filing a claim during the off-season.

• Are/were not in satisfactory immigration status or legally authorized to work.

• Are attending school during normal working hours for your occupation.

• Are not physically or mentally able to work during normal working hours for your occupation.

If one of these above options fits your situation, you still might be able to receive benefits, but this is up to your case worker to decide.

Requirements to continue receiving benefits:

You must satisfy all of the requirements to continue receiving benefits. You do not get to receive them automatically.

1) You must looks for work each week. Joining a temp agency or job placement agency is a great way to achieve this easily.

2) You must submit a new form every two weeks. If you do not, you will not receive benefits. You can easily file this online at https://ccr.edd.ca.gov/CCR/Pages/Public/ExternalUser/UIOnline.aspx?

3) You must not be too sick or injured to work.

4) You must not be taking college classes that conflict with your ability to perform work during normal work hours. For example, if you take online classes at night at this does not interfere with your ability to work, you can still receive benefits.

5) You did not refuse any work.

6) You did not work, even if you were not paid.

7) You did not earn any money from any source. If you did, you must report it and benefits will be reduced by 75% of what you earned. For example, if your weekly benefit amount is $450 and you earned $340 that week, then your benefit is $195 for that week:

$450 – ($340 x 75%) = $450 – $255 = $195

WARNING: If you do not report this earning, it is considered fraud, can result in losing all of your benefits and paying back benefits, AND can result in jail time.

NOTE 1: Just because you did not earn that benefit during that week, you don’t lose it. The $255 will be applied to an additional week in the future.

NOTE 2: It is not a bad idea to take work. You will still have more income than if you did not take the work. For example, during that week you earned $300 + $195 = $495, which is more than the weekly $450, so it is beneficial to work even though you lose some of the free benefit for that week, because you still get those benefits at a later date if you remain unemployed.

NOTE 3: If you earned more than $1000, enter $999.99 since this is the maximum the system allows.

Earnings from the following all count as earnings:

• Back Pay Award

• Bonuses

• Commissions

• Holiday Pay

• Idle Time Pay

• In Lieu of Notice

• Jury Fees

• Paid Sick Leave

• Pensions

• Piece Work

• Residual Pay/Holding Fees

• Self-Employment

• Severance Pay

• Strike Benefits

• Tips

• Vacation Pay

• Witness Fees

• Workers’ Compensation

It is better to not do work for self-employment during receiving benefits, rather than do the work and not claim it. It is even better to do self-employment work AND claim it.

MOVING:

Moving to another state:

If your job market is poor where you are living, or if there are better opportunities elsewhere, you might want to move to another state where there are more opportunities. But you still might want to receive benefits during this time.

Good news, you can still receive benefits if you move to another state. However, you must update your address with EDD. Mail from EDD will NOT be forwarded even if you officially set up mail forwarding through USPS.

If you move to another state and still want to claim benefits, call 1-800-300-5616 for instructions. Failure to contact the office promptly could result in a delay or loss of your benefits.

If you live outside of California or move outside of California while receiving California Unemployment Insurance benefits, you must register with the State Workforce Agency in your state and follow that state’s requirements and instructions for unemployment work search.

Failure to contact the State Workforce Agency promptly, in order to comply with the registration and work search requirements of that state, could result in a delay or loss of your benefits.

For information on the State Workforce Agency in your state, you can call the Toll-Free Help Line at 1-877-US-2JOBS (1-877-872-5627) or visit the America’s Workforce Network website at www.servicelocator.org.

CERTIFYING AND RECEIVING BENEFITS:

Certifying for benefits:

You must certify every two weeks. You can do this by mail, phone via EDD Tele-Cert, or online through www.edd.ca.gov. Online is by far the easiest and fastest method.

Payment:

You can either have your money mailed via check, transferred to a Bank of America EDD Debit Card, or transferred directly to your bank account via Direct Deposit. Direct Deposit is by far the best choice.

You should receive payment within a couple days after receipt of your filed claim every two weeks, if you used Direct Deposit.

UI Checks are only valid for 12 months after he date issued.

CONTACTING EDD:

Contacting the EDD Office to speak to a real person:

It can be near impossible to get through to a real person if you don’t know these phone tips. Check out these tips and tricks for getting to a real, live person at any EDD office: Getting through to a live person, a real human at EDD

V-45 what does this mean on the last column?

Wow… Thanks to the info re edd. Question? I made an error on one of my certification UI online. Now I am having to file an appeal. Boo. Any info on how to write a “winning” letter considering it wasn’t a big mistake, but edd has made it one. Thanks again.

Hello I have a question. I sent back the first certify forms via mail. Haven’t gotten my card just yet since it’s the first one. Then I was told that it’s much faster through online. I found the online version on my Edd account but I already sent the mail version. Can I still do the online version right now (2 days after I sent the paperwork) without messing anything up? Or should I just wait this one out until I get my card and then maybe do only online after that? If I get the mail documents can I not send them and do online?

I applied for ui 3 weeks ago (Friday). It says i have been paid for both weeks ($435 no withholding) and have not recieved any money/debit card. My mailing address is correct. Ehere is it?

I just checked my UI account and it says I was paid 2 days ago… but i’ve gotten neither DD nor a debit card. Have you gotten paid? How long did it take, how many days after it claimed you were paid on your UI account?

Thank you,

Tom

If you choose debit card then the card is sent on the date it says “paid” and then it takes 7 to 10 business days to arrive.

Hello! I was laid off March 13, 2020, so the base period they used is Dec. ’18. However, since Nov. ’19 I have been making significantly more than I was then. How do I get them to base my WBA on more recent income?

As it stands, they awarded $45/we. When I report what few PT hours I’ve been able to get, that will reduce me to $0 benefit…

The only way is simply to wait until the higher income is part or all of your base period – BEFORE you file. This sometimes means waiting without income in order to receive a better amount per week.

when reapplying for a new claim question #6 ask …in the past 12 months have you filed for an unemployment claim. technically if I started my unemployment last year my answer would be the answer be yes?

I’m trying to file for unemployment do I declare money I receive for housing exchange students I am 1099 at the end of the year .

I received a letter stating that I have received all my benefits payable to my claim and no extended benefits are available. However, it also states that I may file a new claim before my expired date, which is in August of this year. I am so confused lol. Can I or can I not receive anymore benefits??? I was laid off after working for 5 years and I am still looking for a new job. Thank you in advance for your help!

What to do if the temp company went back on their promise per salary and hours?

I stuck the assignment out for as long as possible until it wasn’t cost-effective to travel for less than four hours of work. I wound up resigning as it wasn’t going to change, and the supervisor tried to claim i had ‘promised’ availability months ahead of time for this assignment after i told him that wasn’t realistic for me.

1) part time work- If i couldn’t work and used a paid sick day with my job, do I still have to claim that I was “too sick to work” on the form, even though I was paid for it? I’ll still report the earnings.

2)If I receive a workers comp check for 2 of the days, do I still have to put that I was “too injured to work” for those days, or just report the earnings?

I was laid off in July 2017 I filed my claim and was denied I was in a car accident and broke my back and had nobody to help me so I never got to dispute it can I still file a claim or dispute my first claim?

If I have weeks available for certification, how much time do I have to do so after the date begins? I’m will be certifying today but available certifications were posted the day before.

Why does my award letter say $0 I worked all year long made over 9,000 each month? But online it has my balance of 11,700 and weekly amount ok 450

It could be a mistake or you could have overlooked something. You will need to call and speak to your representative, best of luck. Let us know how it works out.

Hey!

I really need some help with this. My benefit year doesn’t end until December of this year. I stopped getting paid in the beginning of July.

I unfortunately haven’t been able to find a job yet, which means I am completely broke with no help at all and the EDD website is saying “You have received all benefits payable to you at this time. You cannot file another California Unemployment Insurance claim until your current benefit year ends.” Is there anything I can do to get an extension?

Employers pay for unemployment through a 15% payroll tax. This does not “bleed” your former employer dry… nor do they directly pay for it. This is a huge misconception.

Hi I was a tipped employee in California and I’m trying to fill out my unemployment forms. Not sure what I need to put for my base pay – do I need to put my whole gross income for my tips and my hourly pay, or do I just subtract my tips and just put what I made hourly from just the employer? They do tax me on my tips. My paystubs are so confusing. Also will I be eligible if I was fired because I received a bad Mystery Shop?

These are questions you will need to ask your unemployment representative. If I were you, I would not mention being fired or any reasons leading up to it. If you are not eligible, you won’t get it. If you are eligible, you will, it’s as simple as that. Don’t give California any reason to deny your benefits.

Hello,

So last year I was on unemployment for the full 26 weeks before it was exhausted. Then I found a job and have been working there for a year and a half. Unfortunately the company is going out of business so I will again have to file for unemployment.

My question is: does my previous unemployment claim benefit payments count as eligible wages for determining my new unemployment claim benefit amount? Basically can I count former unemployment income as wages for EDD to determine my new recent benefit amount? I have searched numerous times for an answer both on EDD site and other forums but with no answer. Any help would be most appreciated. Thank you.

I was laid off in Washington State and relocated to California. I have exhausted my unemployment benefits in Washington. I have lived and worked in California for many years prior to moving to Washington. Would I be eligible to apply for unemployment benefits in California?

I filed for unemployment on 1/9/17. I just filed my claim for the past two weeks today, 1/24/17. How much longer before I can expect to receive my debit card? I could not find an option to have the benefit direct deposited into my personal bank account.

I worked for a Company for Two years before leaving to start my own business. I was self employed for 2 months before they asked me to come back, which I said yes to. I have been back for 2 months and now it doesn’t look like things are going to be as long term as they said. I’m affraid if I get let go I won’t qualify to claim Unemployment, is this true? What will happen to the 2 years I put in before I left?

I worked for a Company for two years then left for another position for two months, they called and asked me to come back. I’ve been back back for about two months now and things aren’t looking permanent anymore, I’m afraid if they lay me off I won’t be able to claim unemployment. Does all the time I put in before just disappear?

Hi, I was “furloughed” from work (forced time off) the last two weeks of December, and filed my claim on New Years Day.

So in the EDD system, my first week to certify for claim was the week of 1/1 through 1/7. But I went back to work on 1/3, so I am not sure what to do. I want to certify that I didn’t work the weeks of 12/16-12/31. Is there any way to do that, and if not what do you recommend I do?

Individuals should apply for benefits as soon as they are unemployed, or working less than full-time. All claims are effective on the Sunday prior to applying for benefits, and have a one week unpaid waiting period. The waiting period does not begin until the claim is filed.

So you can’t make it effective Dec 16-31.

Hello all,

I have a question about the skip week / first week waiting period before benefits are paid.

I filed in October, but I ended up with more shifts than I anticipated and stopped filing. I reopened my claim on Dec 17 (sat) since I knew I did not have any shifts for Dec 25-31.

After I sent in the weeks of Dec 18-31, EDD said that the 1st week was too much earnings (true), but the 2nd week was a skip week/waiting period.

I’m confused, since I thought the skip week was always the first week, and only when you initially filed for unemployment versus reopening your claim.

Can anyone clarify this for me?

Thank you!

What does it mean if my status changed from pending payment to paid, but no money is on my debit card or pending in the bank? Does this mean i was approved?

Hi Heather, it sounds like you are approved but it can take 2 to 3 days for payments to hit your account, as is normal for money sent to bank accounts. Hope this helps!

I wish to stay discreet about my recent lay off. Do all former employers within the eligible base period get contacted? Or just the most recent one? How are past wages confirmed?

Hi Sally, I can’t say for sure but I am pretty sure your employers won’t know about the unemployment; they most likely draw your IRS records, not contact your past employers directly. You should ask the representative just to be sure.

How long do you have to file for unemployment after a layoff

Please see the included chart, depending on when you file your benefits could be different.

I have a similar question as John below:Hi Terri,Does EDD benefit extension not exist anymore? Another question is my current UI benefit expired Last month and said I had to wait until this month to re-apply. I’ve been able to work a little on on-call jobs but not a full or temporary status. Can I apply for another 12 month extension (or until I find permanent employment) ?

Hi Terri,Does EDD benefit extension not exist anymore? Another question is if my current UI benefit expires Feb next year, will I be able to apply for UI benefit in March 2017 and get benefit?

I was let go of my job on the 10th of August 2016, I started the job in January of 2016, I’m very confused, should I file right away or should i wait?I’m not sure what quarter is going to give me the best benefit, can you help please?

You need to determine what your benefits will be using the charts above. It may seem hard to have to wait but sometimes if you wait you might get a much higher payout depending on your situation.

Wow! Your information was so helpful. My beginning date was the first week of April 2016, my claim ending date is 4/1/2017 I’m stressing. I’ve read all types of information yours seems to be the best. I believe you said I have to reapply? (nervous)

Yes you’d need to reapply in April of 2017 to continue for another year assuming you still have benefits by that time.

My claim that I filed July 23, 2015 ended July 25, 2016. I am filing a new claim today, July 29, 2016. Do I answer “Yes” or “No” to the following question: “Have you filed an Unemployment Insurance Claim in California in the last 12 months?” Thank you

Your original claim was in July of 2015, but you have to renew that claim every two weeks to receive benefits, so the last claim you filed was actually in July of 2016, and a few days is shorter than 12 months so the answer is “Yes”, you have filed a claim in the last 12 months.

I filed my claim 5 days before the start of July. My quarterly earnings would have been double if I had waited a few days to file should I cancel my claim and then re-file? If I were to have filed after July 1 (I was let go June 20th) I would be elligable for maximum benefits, but because I filed a few days early I am getting significantly less. Please help.

It might be too late now. You should ask your rep if they will change it.